Availability of Rental Home Financing loan programs continues to give real estate investors an edge in the market. A tight mortgage market has been blamed for holding the US property market back from its full potential for years. However, while that hasn’t changed too much for regular home buyers, capital markets appear to continue to be fueling rental home investment activity.

Availability of Rental Home Financing loan programs continues to give real estate investors an edge in the market. A tight mortgage market has been blamed for holding the US property market back from its full potential for years. However, while that hasn’t changed too much for regular home buyers, capital markets appear to continue to be fueling rental home investment activity.

Tight Mortgage Lending Standards Continue In 2022

The latest reports show that despite increased confidence and sales activity in the housing market, mortgage lending remains tight for consumers. The National Association of Realtors’ Economists Outlook and mortgage originator survey shows both concerns over-servicing issues and regulatory risk as significant factors in restricting new lending activity.

The Urban Institute and Market Watch report that lenders have still been turning down over 1 million loan applications per year, from borrowers who would have been approved in 2001. In fact, Market Watch says more people aren’t even bothering to apply for credit.

Is a blanket mortgage loan just what you need to optimize your rental property portfolio? There are thousands of real estate investors out there with multiple rental properties, who are not yielding the best possible returns. Blanket mortgages could be one of the simplest and most effective options for turning this around.

Is a blanket mortgage loan just what you need to optimize your rental property portfolio? There are thousands of real estate investors out there with multiple rental properties, who are not yielding the best possible returns. Blanket mortgages could be one of the simplest and most effective options for turning this around.

What is a Blanket Mortgage Loan?

A blanket mortgage loan is a single loan that can be collateralized by multiple properties. For example; instead of applying for and juggling 10 individual loans on 10 single-family homes or apartment buildings, investors can use a single blanket loan to borrow against all of them. It is one set of paperwork, just one loan to service each month, or to consider refinancing or retiring in the future.

There can be many advantages of these loans for optimizing income property portfolios.

Rental property investment activity is expected to soar in 2017 fueled by new confidence and a brighter economic outlook. Home sales hit a new record in January 2017 according to NAR and the US Census Bureau. Builders are expected to continue to expand, and investors are eagerly searching for deals. It all bodes well for the market for the foreseeable future. At least for those with the capital and financial sources to seize on current opportunities.

Rental property investment activity is expected to soar in 2017 fueled by new confidence and a brighter economic outlook. Home sales hit a new record in January 2017 according to NAR and the US Census Bureau. Builders are expected to continue to expand, and investors are eagerly searching for deals. It all bodes well for the market for the foreseeable future. At least for those with the capital and financial sources to seize on current opportunities.

The New Economy

We are clearly in a new economic mode, with multiple fundamentals signaling greater times ahead. In February 2017, private US employers added almost 300,000 jobs, beating expectations by close to 30%. Tens of thousands of addition jobs are to be added as manufacturing firms return to the US, or expand their American footprints. Fox Business reports that wages have finally been rising. Up 3% already, higher pay is likely to be compounded as employers compete for workers.

At the same time stock indices have been notching up new record highs, and the Snap IPO has pushed tech to what some call almost ‘too big to fail’. So, while the economy looks great, forward thinking investors are looking to capitalize on the yields and equity gains that can be locked into in rental property investments.

Stated income loans are making a big comeback for commercial real estate financing After years of tight credit markets commercial real estate funding is flourishing again. Many have been sitting on the sidelines waiting for more lenient loan programs to return. Now they are here!

Stated income loans are making a big comeback for commercial real estate financing After years of tight credit markets commercial real estate funding is flourishing again. Many have been sitting on the sidelines waiting for more lenient loan programs to return. Now they are here!

Stated Income Loans

Stated income loans are a vital part of the real estate industry, and the economy. Now that they are returning the effects may not only brighten the finances of individual investors, but the wider market as well.

Stated income loans allow borrowers to qualify for real estate financing, without having to jump through all of the paperwork hoops, hassles, and time drain of full documentation underwriting. This not only provides investors with speed and efficiency advantages but can be an absolute necessity. Many experienced and savvy property investors have sat on the sidelines because they don’t want to deal with the inefficient complexities and quirks of income documentation.

Others, who are self-employed, are full-time investors, those who have complicated finances or advanced tax sheltering vehicles in place simply can’t verify income thoroughly enough. That ironically even spread to former Fed chairman Ben Bernanke, when even he couldn’t qualify to refinance his own home.

As stated income and other expanded qualification loans roll out and spread we should expect many more seasoned investors return to the market, while firms expand their acquisitions.

Each year is a new journey, it’s time to choose your paths and where you’re heading. It’s time to choose who you’re going with, how you’re going and when you’re going, we want to be there with you to help in that success.

Each year is a new journey, it’s time to choose your paths and where you’re heading. It’s time to choose who you’re going with, how you’re going and when you’re going, we want to be there with you to help in that success.

Choose to experience beautiful twilights and incredible trips, and to smile spontaneously. Choose to cultivate friendships, and spend time among good friends. Choose to love, constantly and abundantly, and may this never be too little. Because every good choice we make deserves to happen someday.

As this year draws to a close, we at Rental Home Financing would like to wish you a Happy New Year and thank you for your patronage over the years. Our company would not have been this successful had it not been for the support that we have been provided with by our most prime assets – our customers.

We anticipate that the coming year will bring with it more in terms of mutual success. Rental Home Financing is committed to providing you with exceptional services and we will do our best to keep our service standards high in the next fiscal year as well.

Supply is Shrinking, Investor Profits Rising!

The rental housing in the Indiana real estate market market has been growing fast in the past 3 years. Real estate agents are selling homes now faster than ever seen. Our highly competitive rates, plus the improving job markets and recent expansion of flexible lending requirements for blanket mortgage loans has Indiana property the best since 2006.

The rental housing in the Indiana real estate market market has been growing fast in the past 3 years. Real estate agents are selling homes now faster than ever seen. Our highly competitive rates, plus the improving job markets and recent expansion of flexible lending requirements for blanket mortgage loans has Indiana property the best since 2006.

The increase in Indiana home buying has led to a shrinking supply. This is leading to a robust market providing rental home investors the best accumulative values not seen since the last peak a decade ago. New blanket loans for investors helps ensure the pace.

Future Investor Profits Look Great

Future Investor Profits Look Great

There’s still plenty of demand from renters and buyers on the in search of a home. The low supply and high demand means your rental and resale profits continue to grow.

Demand for real estate continues to push forward and it's economic foundations remain strong. We agree with most forecasts for the upcoming year expecting expecing continued growth in the real estate markets for investors

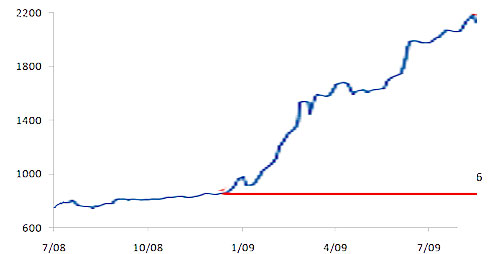

Data for the locations where homes are in most demand are provided in the chart below. The data is ranked by montly progress by realtor.com, not yearly so keep that in mind. For example, Oregon has a huge housing demand growing from the influx of people from california, on a yearly progress chart would surely make the top.

2016 Real Estate Trends: Urban vs. Suburban Investment Properties

What current investment property loan, development, and media trends are impacting urban and suburban real estate? Where are the opportunities? How can investors take advantage of them?

2016 Real Estate Trends

There are a number of significant trends influencing the direction of the market, and where the profits are this year.

These include:

- Low investment property mortgage rates

- Affordability

- Local city planning and appetite for revenues

- Developer profits

- Millennial buying power and preferred property features

Investing in property is an art, seldom mastered by only a few. Managing a successful rental portfolio is not as easy as its seems on the surface. Sometimes, investments backfire and you have to quickly get rid of them to save your entire portfolio. People can go under sooner than they think and often end up in a lifetime of debt. As gloomy as it may sound, if done correctly, there is nothing more rewarding than real estate investing.

Investing in property is an art, seldom mastered by only a few. Managing a successful rental portfolio is not as easy as its seems on the surface. Sometimes, investments backfire and you have to quickly get rid of them to save your entire portfolio. People can go under sooner than they think and often end up in a lifetime of debt. As gloomy as it may sound, if done correctly, there is nothing more rewarding than real estate investing.

Professional investors work their way through complex property loans to achieve success. If this is something you aspire to become, here's a comprehensive guide to investing in real estate the right way.

Where Should I Be Investing?

Where Should I Be Investing?

Buy-to-Rent returns are showing buying more affordable than renting in 66 Percent of Markets. Potential buy-to-rent profits increased thanks to rental rate growth outpacing home price growth from a year ago. Some location returns increased to nearly 60% over the previous year.

What locations had at least a 59% increase in buy to rent potential for 2015? The best locations for With a 2015 average range of 3% to almost 27% gross rental yeild depending on location, our question now demands more attention. The average individual average is around 9% but who wants just average results when it comes to investments.

Want to Pay Off Rental Property Loans Faster? Ensure Your Tenants Stay and Pay

The key to success in the rental property investment business is keeping the tenants happy. If your tenants are happy, they are more likely to spend more time in your rental home. It takes a good amount of time and effort to find and retain good tenants, and if you have found an ideal match, you want to ensure that they stay (and, pay!).

The key to success in the rental property investment business is keeping the tenants happy. If your tenants are happy, they are more likely to spend more time in your rental home. It takes a good amount of time and effort to find and retain good tenants, and if you have found an ideal match, you want to ensure that they stay (and, pay!).

Finding the right balance between performing your job correctly and keeping the tenants happy is not always easy. Your goal to pay off your rental property loans quicker can go haywire if the rental setup doesn't work as expected.

Below are the tips to help you get started:

Take advantage of the rental income to qualify for a new mortgage

Are you adding more properties to your rental portfolio? If so, you can take advantage of the rental income to qualify for a new mortgage. You can get great deals on mortgages depending on the gains or losses from your rental property income and the tax returns you filed recently.

Are you adding more properties to your rental portfolio? If so, you can take advantage of the rental income to qualify for a new mortgage. You can get great deals on mortgages depending on the gains or losses from your rental property income and the tax returns you filed recently.

In order to achieve favorable credit, you can make use of close to 75% of the rental income depending on your past record.

Here are some tips to secure a mortgage if you are buying a rental property:

Find Rental Home Loans at Amazing Rates

Rental home loans are always a murkier place, especially for newbies. When it comes to mortgages for rental homes, finding the right deal with affordable interest rates, in the long run, is akin to finding a needle in a haystack.

Rental home loans are always a murkier place, especially for newbies. When it comes to mortgages for rental homes, finding the right deal with affordable interest rates, in the long run, is akin to finding a needle in a haystack.

Your best bet is to be thoroughly prepared before you start down this path.

From an impressive credit score to maintaining the right cash reserves, there's plenty of advice for you.

Here are 6 ultimate ways to make sure you grab the best deal out of the plethora of rental home loans:

Secure a great mortgage

Securing a great mortgage deal for an investment property is a daunting task. Before you step down the business loans for rental property path, it is important to reserve some cash to impress your prospective lender. Remember, a good credit score means a happy lender, so make your credit history strong so that a lender cannot refuse your mortgage application.

Securing a great mortgage deal for an investment property is a daunting task. Before you step down the business loans for rental property path, it is important to reserve some cash to impress your prospective lender. Remember, a good credit score means a happy lender, so make your credit history strong so that a lender cannot refuse your mortgage application.

It is strongly recommended to do extensive research on mortgage financing before purchasing a rental property. Try to develop a healthy relationship with a reliable lender to obtain rental property loans without any hiccups. Remember, lenders consider a mortgage for investment properties to be riskier than for residential properties.

If you think it is easy to secure a business loan for rental property, you are highly mistaken. Investors need to know that investment property loans are different from typical home mortgage. For lenders, these loans are considered as a great risk and they take the risk only when it seems worth taking. Here in this guide investors will understand how investment property are different, how to qualify for this type of loan and from where to get the best deal.

If you think it is easy to secure a business loan for rental property, you are highly mistaken. Investors need to know that investment property loans are different from typical home mortgage. For lenders, these loans are considered as a great risk and they take the risk only when it seems worth taking. Here in this guide investors will understand how investment property are different, how to qualify for this type of loan and from where to get the best deal.

What is investment property loan?

Investors invest in investment property since it gets extra income to the wallet and helps pay off the debts. When purchasing an investment property you need a loan. The business loans for rental property can also be used for refinancing an existing investment, or for real estate development. The mortgage rate and terms depend up on your credit history and these two factors will determine your monthly mortgage payments. There are basically two types of investment property loans: Residential & Commercial.

U.S. Single-Family Rentals Forecast For Q1 2015

Many good options exist for single-family residential rental investors in different U.S. counties. It is now possible for savvy real estate investors to get double-digit returns and rents that escalate more than 10 percent a year. According to a report released by RealtyTrac, about 20 markets have the potential to deliver returns that soar more than 15% and many over 20% during Q1 2015.

Many good options exist for single-family residential rental investors in different U.S. counties. It is now possible for savvy real estate investors to get double-digit returns and rents that escalate more than 10 percent a year. According to a report released by RealtyTrac, about 20 markets have the potential to deliver returns that soar more than 15% and many over 20% during Q1 2015.

According to a recent report that analyzed U.S. single-family housing data, there are many good options available for single-family residential investors. It is estimated that single-family residential rental properties will bring in an average return of 9.05% during this year's first quarter, but 20 individual markets show the possibility of returns that soar more than 15%.

Investment Tips for Real Estate Investors

Investment Tips for Real Estate Investors

The real estate market is unpredictable. But, if you are one of those optimists who believe that the prices will go down, you can surely think of starting out your career as a landlord.

Remember, all investments fluctuate in value over time. However, as we have recently seen, prices are rising with the value of your portfolio.

As a landlord, you should not be concerned about short-term fluctuations in a long-term investment.

Following are some tips to get started:

Tips to lower your rental taxes

Navigating the tough waters of tax laws in the USA can be tricky especially if you are a landlord. If you are a landlord, it is important that you know the type of expenses you can deduct for your rental property to help you reduce your taxable income, which eventually reduces your tax liability. Here are the top tax deductions for landlords.

Here are 6 tips to lower taxes on your rental investment property

1. Depreciation

The depreciation expense applies to those things that you have bought for your business that have a useful life even after the current tax year. Here are the three rules to calling something depreciable:

- Expected to last for more than one year.

- Provides value to your business in some way.

- Becomes invaluable or wears out over time.

What to know before investing in real estate

What to know before investing in real estate

Nearly everyone knows it - real estate investing can give you a promising financial future! However, just because real estate investing has a reputation for delivering great returns and building wealth does not mean that all property investments are the same.

The key to getting great returns lies in understanding the basics of what makes a great investment and how to buy the best real estate.

This article will help you navigate through the clutter by offering you important things you must understand before you buy your first investment property.

Rental Property Lending with Blanket Loans

Rental Property Lending with Blanket Loans

A blanket mortgage is a type of rental property lending that allows the purchase of multiple parcels of real estate under the shade of a single mortgage. The finance of all the properties is taken as collateral by the creditor.

During the release clause, the integrity of the mortgage can remain unharmed if one or more real estate parcels within the blanket are sold. For example, if an investor acquired a blanket mortgage to purchase six buildings and sold two of them, he/she would still maintain the blanket mortgage for the remaining four properties. A blanket mortgage is often used by real estate developers to finance the purchase and development of land.

The Benefits of Blanket Mortgages with Rental Property Lending

Blanket mortgages offer a more efficient, cost-effective way for real estate investors to acquire financing. For a real estate investor, the alternative to a blanket mortgage would be to obtain separate mortgages for each property. For instance, if a company were planning to build a subdivision with 30 houses, it would need to take out 30 separate mortgages to finance the purchase and construction of the 30 homes.

Everything Investors Always Wanted to Know About Yield Maintenance

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

Real estate investors looking for financing on a single-family rental portfolio may overlook the importance of yield maintenance for a loan prepayment. It is something that investors must be aware of, as it may have a significant impact on their financing strategy.

What is Yield Maintenance & How It Works?

Yield maintenance is a prepayment premium that allows investors to attain the same yield as if the borrower made all scheduled mortgage payments until maturity. Yield maintenance is common in the commercial mortgage market, but only a few investors know about it in the residential lending market, so investors who are mainly associated with residential loans may not be familiar with how it works.

5 Ultimate Tips to Know When Refinancing Rental Property Mortgage

Homeowners often choose rental property ownership as an investment or something that yields consistent results. Over the years, however, you may need to refinance your rental portfolio, whether to take advantage of lower interest rates or decrease the monthly mortgage payments. The process of refinancing is not easy when it comes to rental properties.

Homeowners often choose rental property ownership as an investment or something that yields consistent results. Over the years, however, you may need to refinance your rental portfolio, whether to take advantage of lower interest rates or decrease the monthly mortgage payments. The process of refinancing is not easy when it comes to rental properties.

Homeowners face a fair share of hurdles during the rental mortgage refinancing process. They need to know how to overcome those hurdles to get a new mortgage for their properties quickly.

There are some key considerations that must be kept in mind when planning to refinance your rental portfolio.

1. Know your Rental Investment Properties

When exploring your potential lending options in refinancing, it is important to have the most recent and accurate data on your assets. Acquisition date and price, current lease information, rehab expenses, maintenance/repair costs, insurance and taxes are some vital data that can lead you to the right financier. It is advised to organize the data in a clean excel file that is easy to understand for the lender.

Also, the lenders appreciate a recent property inspection report from a certified source. This will not only make you credible but also increase the available options.

Best Investment Property Loans - What to look for.

Best Investment Property Loans - What to look for.

What should real estate investors be looking for in a great investment property loan and mortgage lender?

Below are 6 criteria that we feel are important to consider when applying for an investment loan.

TOP 6 Investment Property Loan Considerations

1. Non-Recourse Loans

You want to make sure the loan is non recourse. Non-recourse loans are one type of investment property loan where the lending institution cannot come after the borrower for any reason if the loan defaults.

This type of loan is usually only given to very qualified borrowers with great credit scores and a large amount of equity in the property. This means that if you default on the loan, the lender can only go after the property itself and not your personal assets.

While he hasn’t always followed his own advice Donald Trump has said for decades that selecting non-recourse loans is the smart way to go to reduce liability, and separate personal from business and investment assets and debt leverage.

Tactics for Best Deal on Rental Property Loans

As rental property financing becomes more accessible for real estate investors more and more are seeking out new acquisitions and are looking to refinance investment property to maximize returns. However, there can be distinct differences in the terms different investors are able to obtain.

As rental property financing becomes more accessible for real estate investors more and more are seeking out new acquisitions and are looking to refinance investment property to maximize returns. However, there can be distinct differences in the terms different investors are able to obtain.

Here are five tips to consider to enable investors to land the best possible deal on their next rental property loan…

Rental Home Financing

9465 Counselors Way

Suite #200,

Indianapolis, IN 46240

About Rental Home Financing:

Rental Home Financing, as the best mortgage lenders we originate rental home loan products and cash out refinance investment property loans as the best investment property refinance lenders. Commercial blanket loans are available with a commercial purpose to suit your needs.

Also, as DSCR loan specialists, we are currently authorized to make such loans in most all areas of the United States. Specific circumstances will determine whether we have the ability approve/close portfolio rental home loans in your state(s). When you are ready to get a mortgage for rental property, we are ready to serve you.

Best Investment Property Loans - What to look for.

Best Investment Property Loans - What to look for.